Visa Holder, U.S. Tax, FBAR & FATCA: H-1B, L-1, B1/B2, E-2, E-3, O-1, EB-5 and Offshore Reporting - YouTube

Report: Maine Historic Preservation Tax Credits projects have generated $166 M in tax revenue | Mainebiz.biz

What is the Minimum Tax Credit and How Does it Work for ISOs? — San Francisco, CA | Comprehensive Financial Planning

Amazon.com: Tax Credits Are Sexy: What Every Organization Needs to Know about the Employee Retention Credit: 9798985735703: Marshall, Kevin, Hallett, H. Cody: Books

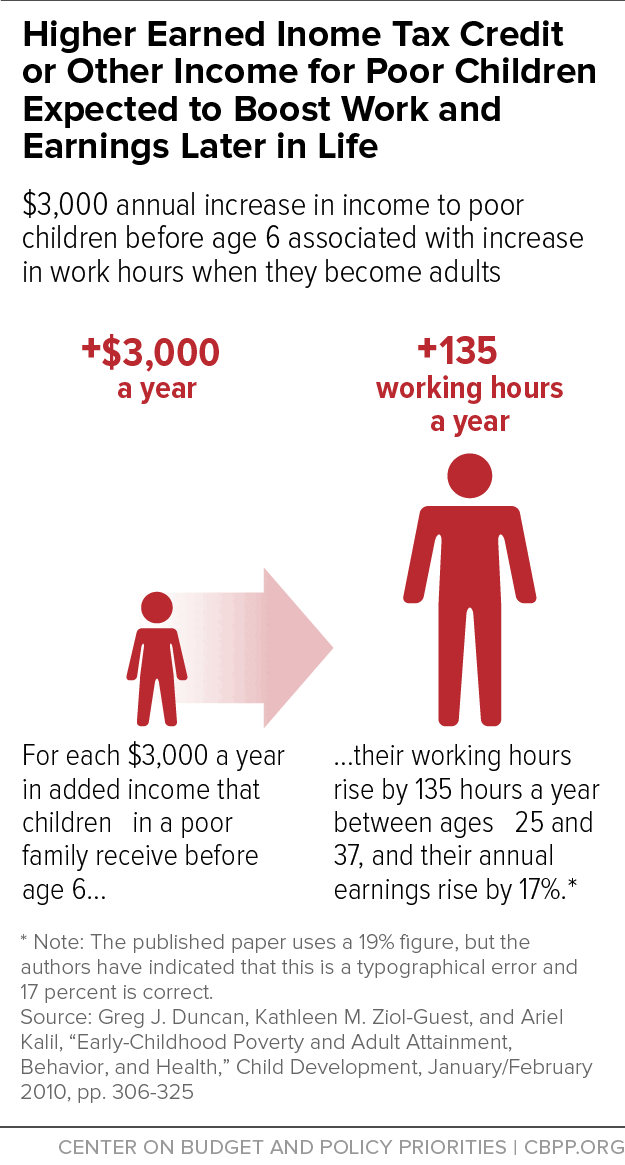

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

Why families claiming child tax credits face delayed tax refunds this year due to IRS law | The US Sun